Filing of GST return Video Guide. This guide is specifically prepared to assist businesses in understanding matters with regards to the tax adjustments and declaration after the repeal of Goods and Services Tax Act 2014 GSTA on 1stSeptember 2018.

Guide To Gst For Healthcare Services Malaysia

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

. Input tax credit mechanism Only GST registered businesses can charge and collect GST. Collecting GST in Malaysia Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident. Notice of assessment wil not be issued.

Malaysia GST Calculator Malaysia GST Calculator - You can now easily calculate GST for Malaysia Amount Applicable GST Rate 6 Excluding GST 000 000 GST Gross Price Including GST 000 000 GST Net Price Calculate GST with this simple and quick Malaysia GST calculator. A Complete Guide Janhavi Wagh Table of Contents In Malaysia Sales and Service Tax SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. GST Custom Malaysia implements efficient.

By or before 30th September 2018. GST-04 Online Submission GST Guide on Updated Bank A ccount Refund Goods and Services Tax is Value Added Tax VAT that is claimable by GST more information regarding the change and guide please refer to. The excess amount of output tax shall be remitted to the.

Online Manual Filing GST 03 Form. GST Guide on GST-04 Online Submission. KUALA LUMPUR Malaysia Feb.

Companies have to declare SST return SST-01 every 2 months bi-monthly according to the taxable period. The following are GST Guides given by the Royal Malaysian Customs Department in dealing with GST requirements by the respective industries. Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers.

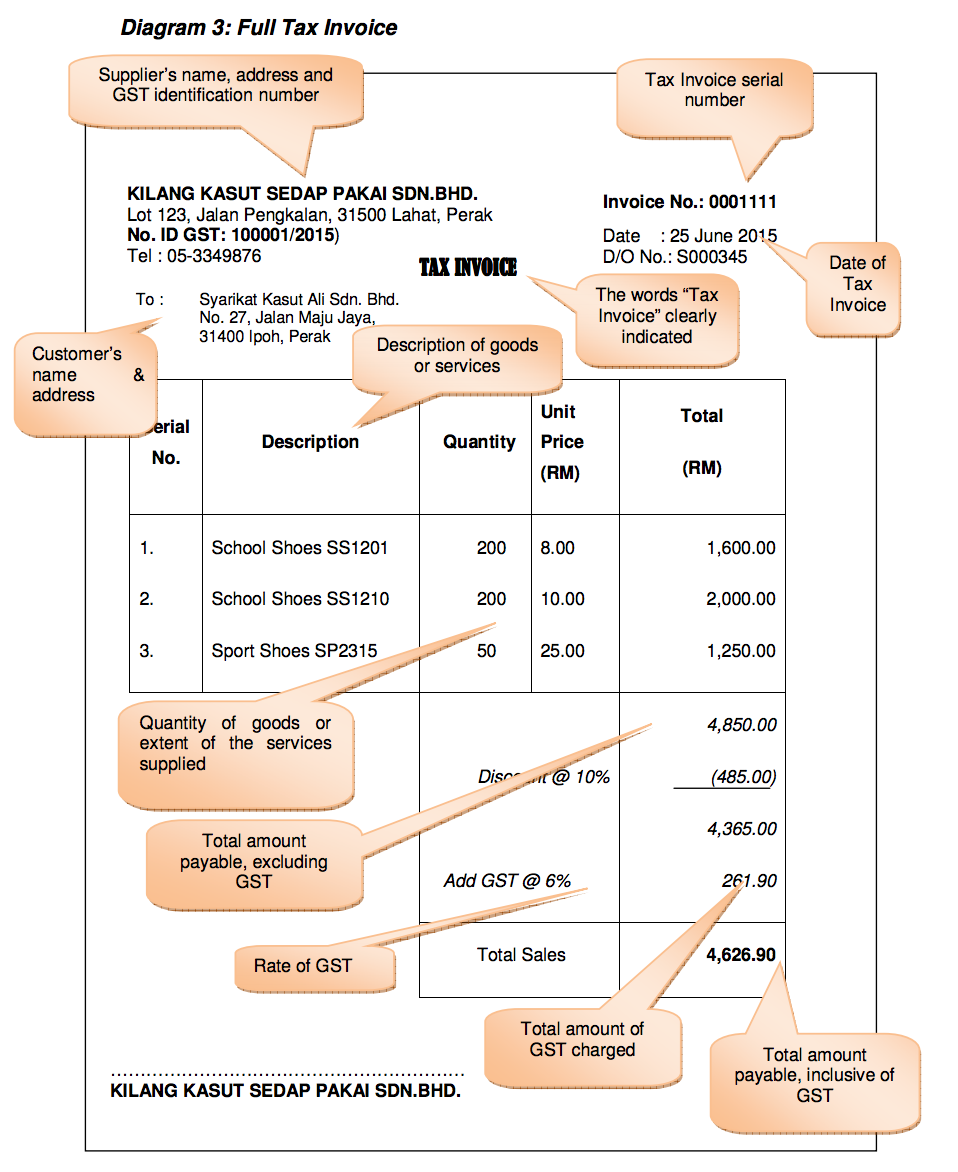

GST invoices in Malaysia In order to comply with tax laws you should include the following information on your invoices to customers in Malaysia. If the tourist makes a purchase when the GST rate charged is standard rate of 6 and he departs from Malaysia when the GST imposed is standard rate of 0 is the tourist still entitled to. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for the year of assessment concerned.

Taxpayer Access Point TAP Returns Payment of GST. Your business name and address Your business VAT number Invoice date. The amendment to the final GST-03 Return should be made would be allowable in the following situations subject to meeting conditions.

This guide is specifically prepared to assist businesses in understanding matters with regards to the liability of good and services tax GST on the issuance of tax invoice debit note credit note and GST treatment on retention payment after the repeal of Goods and Services Tax Act 2014 GSTA effective 1st September 2018. Registered person are still required to submit GST-03 until further notice. It is easy to calculate GST inclusive and exclusive prices.

This guide covers everything you need to know about Sales and Service Tax in Malaysia as a small business owner. SME Corp on GST eVoucher. Segala maklumat sedia ada adalah untuk rujukan sahaja.

1 Self Assessment System SAS is based on the concept of Pay Self Assess and File. SST return has to be submitted not later than the last day of the following month after the taxable period ended. The return must be submitted regardless of whether there is any tax to be paid or not.

1 Accommodation Premises and Similar Establishment revised as at 14 July 2014 2. According to the GST guides no GST adjustment is allowed to be made after 31 August 2020. Submission 5 minutes Processing Acknowledgement page will be displayed upon successful submission.

It would be advisable for you to read through these two Guides and make the necessary amendments. For members of the public to check if a business is GST-registered. FAQ 160KB GST Registered Business Search.

There are two type of ID. Contact Us Crowe KL Tax Sdn Bhd C15-5 Level 15 Tower C Megan Avenue 2 12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Malaysia Director Indirect Tax Business Outsourcing Chris Yee. Online Payment a Procedure to Login Return Payment.

19 2014 PRNewswire -- GST Customs Malaysia is ready with an online system for GST tax submission and issuing GST refund. Malaysia GST Malaysia switched from Sales and Services Tax SST to Goods and Services Tax GST in April of 2015. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX.

To view Sales Tax License Information and Sales Tax Return Schedule. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax.

The manual guide covered topics of below. The updated guides are available on the government website. Forms SST-02 and SST-02A are used to report sales tax and services tax and address procedures on filing these forms as well as the available payment methods.

To Submit Sales Tax Return. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Accounting of output tax on tax invoice issued on or after 1 September 2018 for taxable supplies made during the GST era.

1 Business Registration No 2 IC No. A search can be performed by using the business name GST registration number Unique Entity Number. MALAYSIA GOODS SERVICES TAX GST Royal Malaysian Customs Department AFTER you TAXPA ACCESS POINT A BETTER Tax SYSTEM Cancel Return 09 tags THE SERVICE.

Within 30 days 5 After 30 days but not exceeding 60 days additional 5 Every subsequent 30 days or part thereof additional 3 Subject to a maximum tax of 25 of the late payment penalty. Only businesses registered under GST can charge and collect GST. This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

Final GST return that was previously submitted. Please be informed that pursuant to Section 7 of Goods and Service Tax Repeal Act 2018 the non-GST Registrants are required to submit the final GSt-04 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 30 days from 01092018 ie.

Malaysia Accounting Software Best Accounting Software Accounting Accounting Software

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Guide To Gst For Healthcare Services Malaysia

Basics Of Gst Tips To Prepare Gst Tax Invoice

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Malaysia Gst Guide For Businesses

Guide To Gst For Healthcare Services Malaysia

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Guide To Gst For Healthcare Services Malaysia

How To Claim Gst In Malaysia Tips Tips Wonderful Malaysia